Takeaways from the 4th annual Caribbean Aviation Day in the Cayman Islands

ANN RUPPENSTEIN

During the 4th Caribbean Aviation Day held in the Cayman Islands earlier this month, Peter Cerdá, regional vice president, the Americas for IATA, warned that “some Caribbean states are pricing themselves out of the global travel and tourism competition.”

Cerdá provided several price comparisons between travel destinations in the Caribbean and around the world to drive home this point. For example, a flight for an eight day vacation from London, England to Bridgetown, Barbados this October costs around $800. But an average flight from London, England to Dubai for the exact same time frame is only around $600.

“For a family of four, that is a $800 difference just for the flights. Another example closer to home: Miami to Antigua, we are looking at a $900 round trip ticket for the same dates in October. But Miami to Cancun averages to be around $310 for a round trip ticket. Again, for a family of four, that is a total difference of over $2,000 just for the flights,” he noted. “Caribbean destinations are running the risk of pricing themselves out of the global travel and tourism market where passengers have more choice than ever before.”

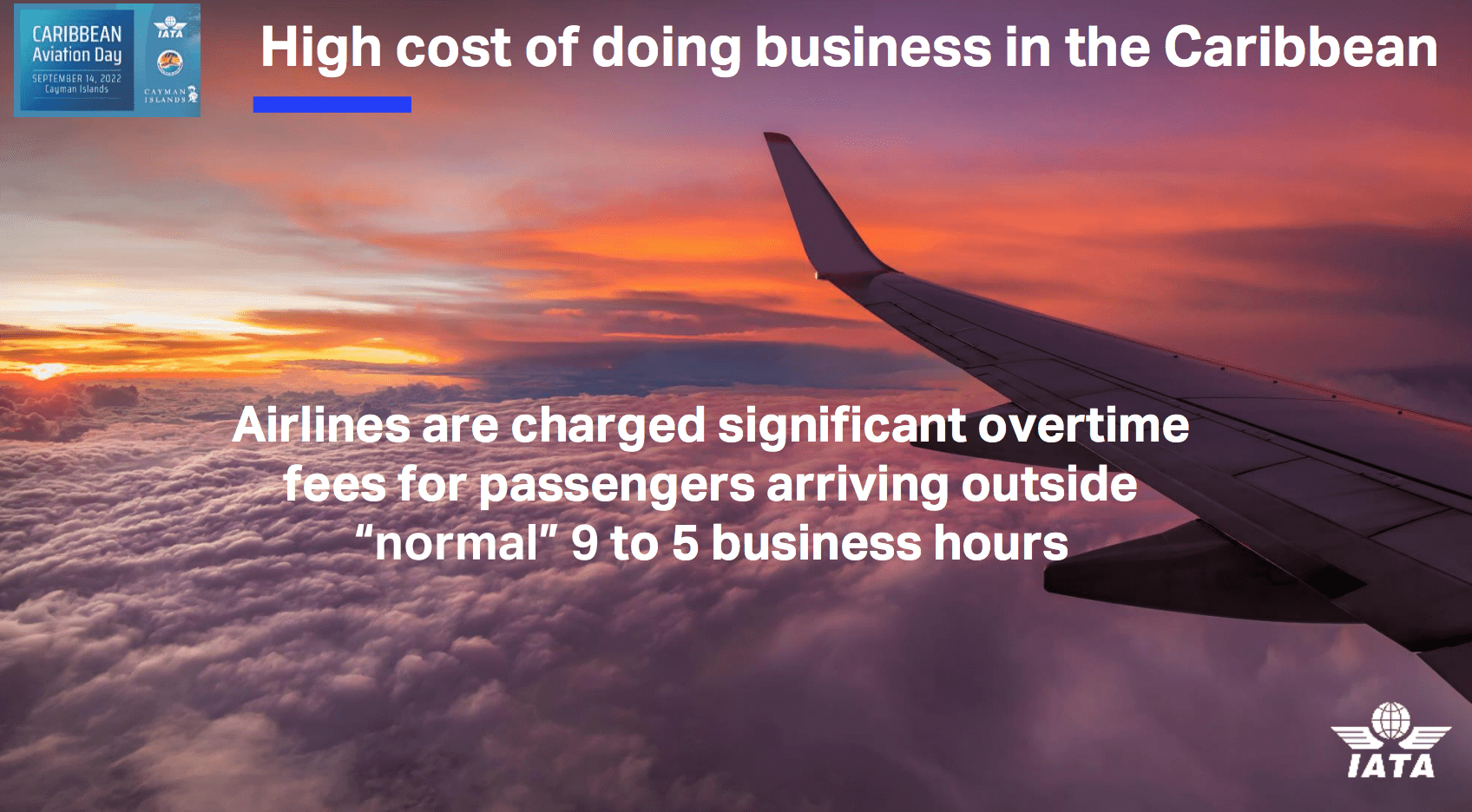

One of the factors contributing to cost surcharges is that airlines are charged fees if flights don’t arrive between regular business hours.

“If passengers are not arriving during ‘regular’ 9 to 5 business hours, airlines are being charged significant overtime fees for each passenger to be processed by immigration and customs,” he shared. “Aviation is not a 9 to 5 business. Global connectivity is around the clock. This process is simply unacceptable and makes no sense as those very same passengers are the ones staying at local hotels, eating at local restaurants, and fuelling local economies, no matter what time they arrive. So why penalize and charge airlines extra who transport these passengers?”

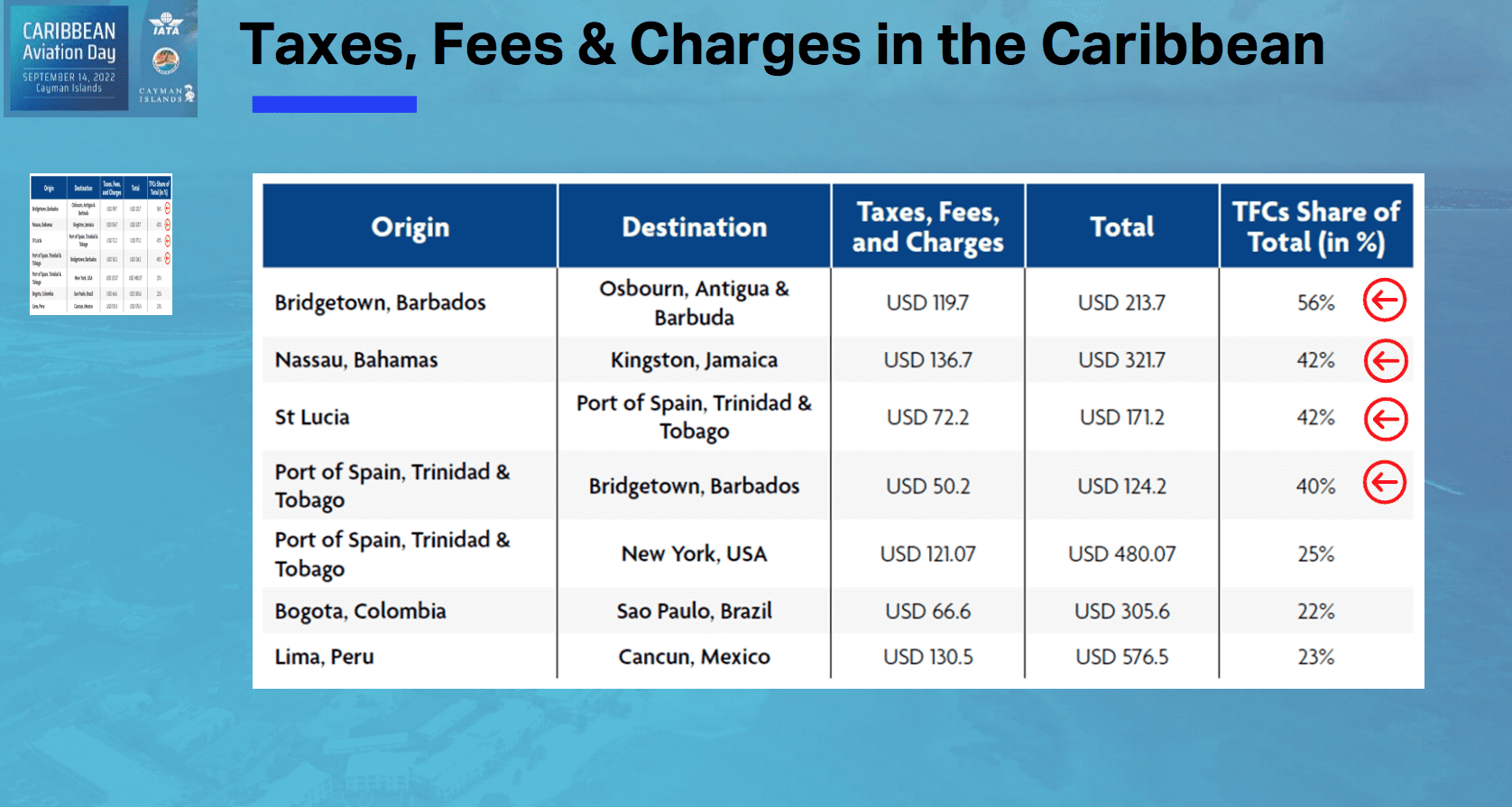

Taxes and fees added to airline tickets also substantially increase the cost of air travel to and from the region. Whereas the global level taxes and charges make up approximately 15% of the ticket price, in the Caribbean the average is double that at approximately 30% of the ticket price. Cerdá noted that in some markets, taxes, fees and charges make up half of the total ticket price.

“On a flight from Barbados to Barbuda, taxes and fees represent 56% of the ticket price. On a flight from the Bahamas to Jamaica, 42%. St. Lucia to Trinidad & Tobago, also 42%. And Port of Spain to Barbados: 40%,” he said. “In comparison, Lima, Peru to Cancun, Mexico, another beach destination, taxes and fees only represent 23%.”

On a positive note, global passenger air traffic has reached 74.6% of pre-crisis levels and in the

Caribbean, the recovery is even faster already reaching 81% of pre-pandemic levels in June. But while international connectivity between the Caribbean, the Americas and Europe has largely been restored, he pointed out that traveling within the region remains a challenge.

“We have only reached 60% of intra-Caribbean passenger levels compared to 2019 and in many cases the only way to reach other islands is via Miami or Panama,” he said. “Offering the Caribbean as a multi-destination region with good, efficient and affordable global and regional connectivity will create a unique selling proposition.”

Cerdá stressed the opportunity for collaboration between governments and the industry to support a sustainable aviation sector as an integral part of the tourism value chain.

“Governments and stakeholders voiced their support for the identified industry priorities during the Aviation Day,” Cerdá concluded. “We now expect to see the appropriate actions and decisions. For example, ticket taxes, charges and fees need to be reduced to bring them in line with the global average. Increasing these would be detrimental to demand. All participants in the travel value chain need to work in unison to rebuild aviation and tourism in the post pandemic world. Our industry stands ready to lend our support to help the region achieve the potential 6.7% travel and tourism GDP increase per annum between 2022 and 2023, as forecast by the WTTC.”

Over 250 delegates from across the wider aviation and tourism industries were on hand for the event, which was held in partnership with the Caribbean Tourism Organization and the Government of the Cayman Islands.

IATA Caribbean Aviation Day outlines priorities for aviation in the region

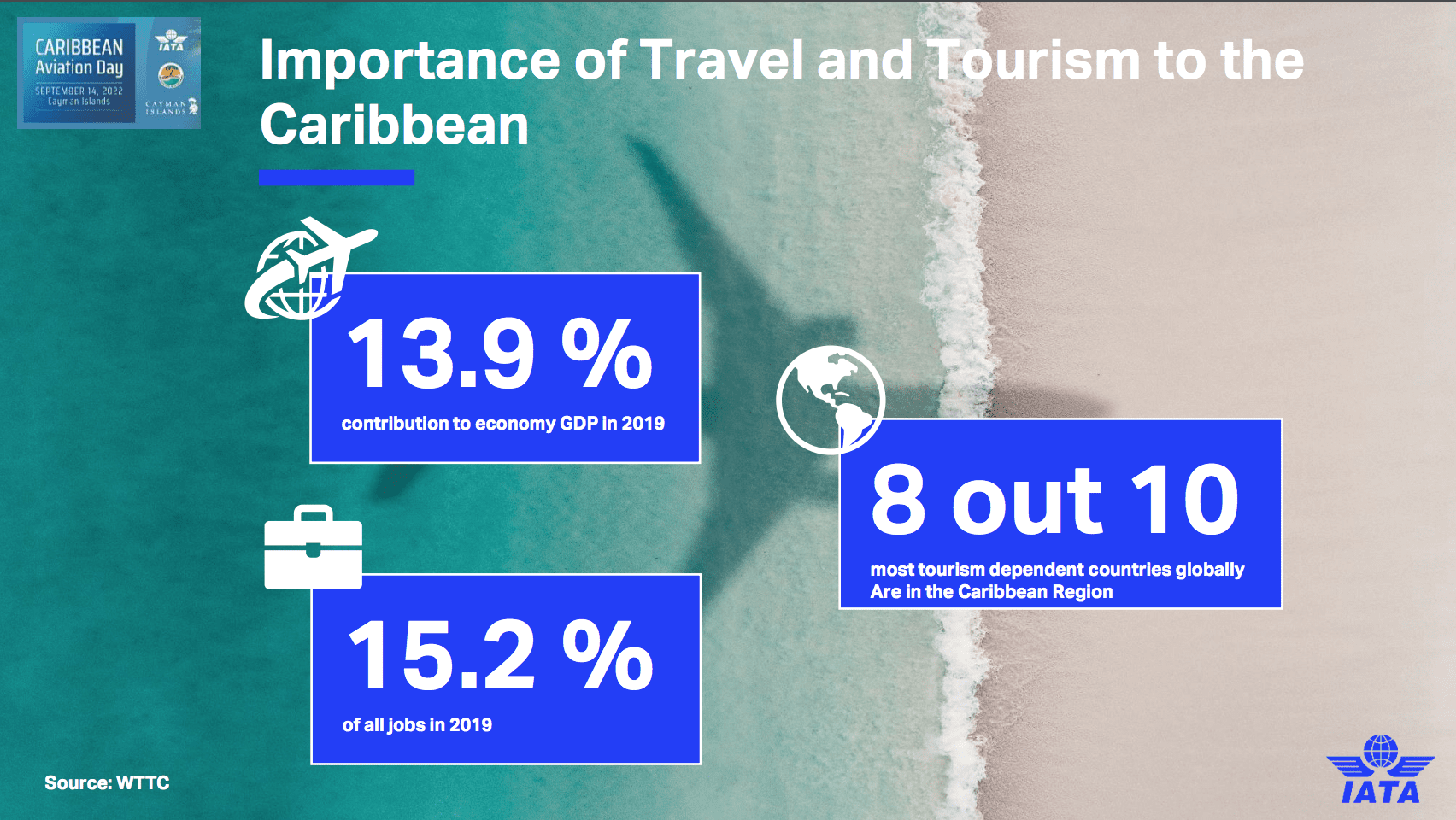

Prior to 2020, Peter Cerdá, regional vice president, the Americas for IATA, highlighted that aviation and tourism contributed 13.9% of GDP and 15.2% of all jobs in the Caribbean region. According to the World Travel & Tourism Council (WTTC), eight out of the ten most tourism dependent countries globally in 2019 were in this region.

“The Caribbean needs to remain an attractive tourist destination,” he said. “The WTTC forecasts a possible annual 6.7% travel and tourism GDP increase between 2022 and 2023 if the right policies are implemented.”

In order to regain and even surpass this contribution, IATA suggested that the following priorities should be addressed:

- Connectivity: While connectivity between the Caribbean and the important source markets of Canada, Europe and the USA largely has been restored, the intra-Caribbean passenger levels have only reached 60% of pre-pandemic levels. Improving this requires a concerted effort to increase air links within the Caribbean. This also is a precursor to offering more multi-destination travel options.

- Multi-destination tourism: To remain competitive with other key tourism markets across the globe, the various Nations in the Caribbean need to look at putting multi-destination offers into the market.

- Seamless travel experience: To facilitate travel to, from and within the region, governments need to work together in order to modernize and simplify the outdated policies and procedures which pose operational challenges to airlines and adversely affect the travellers’ experience.

- Competitive cost environment: At present the Caribbean has some of the highest taxes and fees on airline operations and tickets. By way of comparison, at a global level, taxes and charges make up approximately 15% of the ticket price and in the Caribbean the average is double this at approximately 30%. Today’s travellers can reach the other end of the world with one or two flights, with the total cost of vacations increasingly become a decision-making factor. Hence governments must be prudent and not price themselves out of the market. Along similar lines Air Navigation Service Providers need to ensure that their charges remain appropriate for the actual service provided.